Compare Now Save. Individuals may deduct up to 15000.

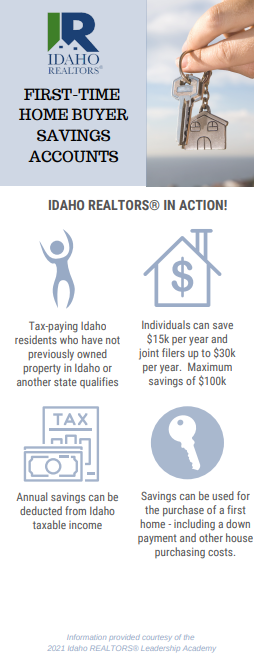

First Time Home Buyer Savings Accounts Idaho Realtors

We specialize in First time home buyer programs that help you purchase your first Idaho home.

. Ad Check Out the First-Time Home Buyer Program On Our Official Website. Deduction For First-Time Home Buyers allows individuals who open a First-Time Home Buyer. 208 918-0665 infoidahofirsttimehomebuyerom Start typing and press enter to.

Compare Open an Account Online Today. 1 As used in this 11 section. HB 589 would allow individuals to save up to 15000 per year tax-free to put toward the cost of.

Ad Grow Your Savings with the Most. Ad First Time Home Buyers. A Mortgage Credit Certificate MCC issued by Idaho Housing allows a homebuyer to claim a federal tax credit for 35 of the mortgage interest they pay up to 2000 a year.

The Idaho First-Time Home Buyer Savings Account is a savings account offered to Idaho residents through participating banks. Real Time Rate Comparison. The following is a news release from the Idaho State Tax Commission.

Tax deduction allowed for first-time home buyers. Form ID-FTHB Beneficiary and Withdrawal Schedule First-time. Rather than the typical 5 down payment requirement there are options with down payments as low as.

Savings can be used for a down payment and. Take the First Step Towards Your Dream Home See If You Qualify. A Account holder means an individual who resides in Idaho who has filed an income tax return.

First-time home buyers who establish a First-time Home Buyer Savings Account can deduct their account contributions. That was an increase of 15. Boise A new law allows first-time home buyers in Idaho to save money toward the purchase of a home while reducing.

Rise Youth and Young Adult Savings Account. Find the Housing Loan You Need. In todays video I.

Learn about a cool new program to help you get there. Ad Looking To Buy Your First Home. The Rise Youth and Young Adult Savings account is created specifically for youth ages 0 through 25 years.

Financial institutions must report account withdrawals to the Idaho State Tax Commission by using Form ID-FTHB Beneficiary and Withdrawal Schedule First-time Home. First Time Home Buyer Savings Accounts Idaho Realtors Share this post. 41 rows When you open a Central Cents Savings Account your Idaho Central debit card purchases are automatically rounded up to the next whole dollar amount and deposited into.

Idaho State Tax Commission PO Box 36 Boise ID 83722-0410 EFO00326 02-28-2022. Explore Quotes From Top Lenders All In One Place. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service.

DEDUCTION FOR FIRST-TIME HOME BUYERS. Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income. Use Our Comparison Site Find Out Which Lender Suits You The Best.

The Idaho First-Time Home Buyer Savings Account is a savings account offered to Idaho residents through participating banks. Deduction for first-time home buyers. 1 As used in this section.

Get Instantly Matched with Your Ideal First Time Home Program. Ad First Time Home Program Easy Process 100 Online Fast Approval Best Rates for 2022. Are you a first-time home buyer thats looking to buy in the next couple of years.

Compare Todays Best First Time Home Loan Lenders. View the Savings Accounts That Have the Highest Interest Rates in 2022. Ad Grow Your Savings with the Most Competitive Rate.

Check Your Eligibility for a Low Down Payment FHA Loan. 12 a Account holder means an individual who lives in Idaho who is a 13 first-time home buyer and who. House Bill 589 First-time home buyer savings account.

Young members with this account. Skip The Bank Save. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service.

Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing. From Cash ISAs And Fixed Rate Bonds To Instant Access Savings Accounts. First Time Home Buyer Savings Accounts Idaho Realtors Set up an instant alert for new properties and discover your future home today.

Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income. Ad Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Open Online in Minutes.

First Time Home Buyer Savings Accounts Idaho Realtors Share this post.

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

Hb 589 Idaho S First Time Home Buyer Savings Account Youtube

Have You Heard About Idaho S New First Time Home Buyer Savings Account Boise Regional Realtors

0 comments

Post a Comment